ソリューション/プロダクツ

リスク評価

データ分析

コンサルティング

最先端の金融工学技術に裏打ちされた高精度な信用リスク評価サービスをご提供します。

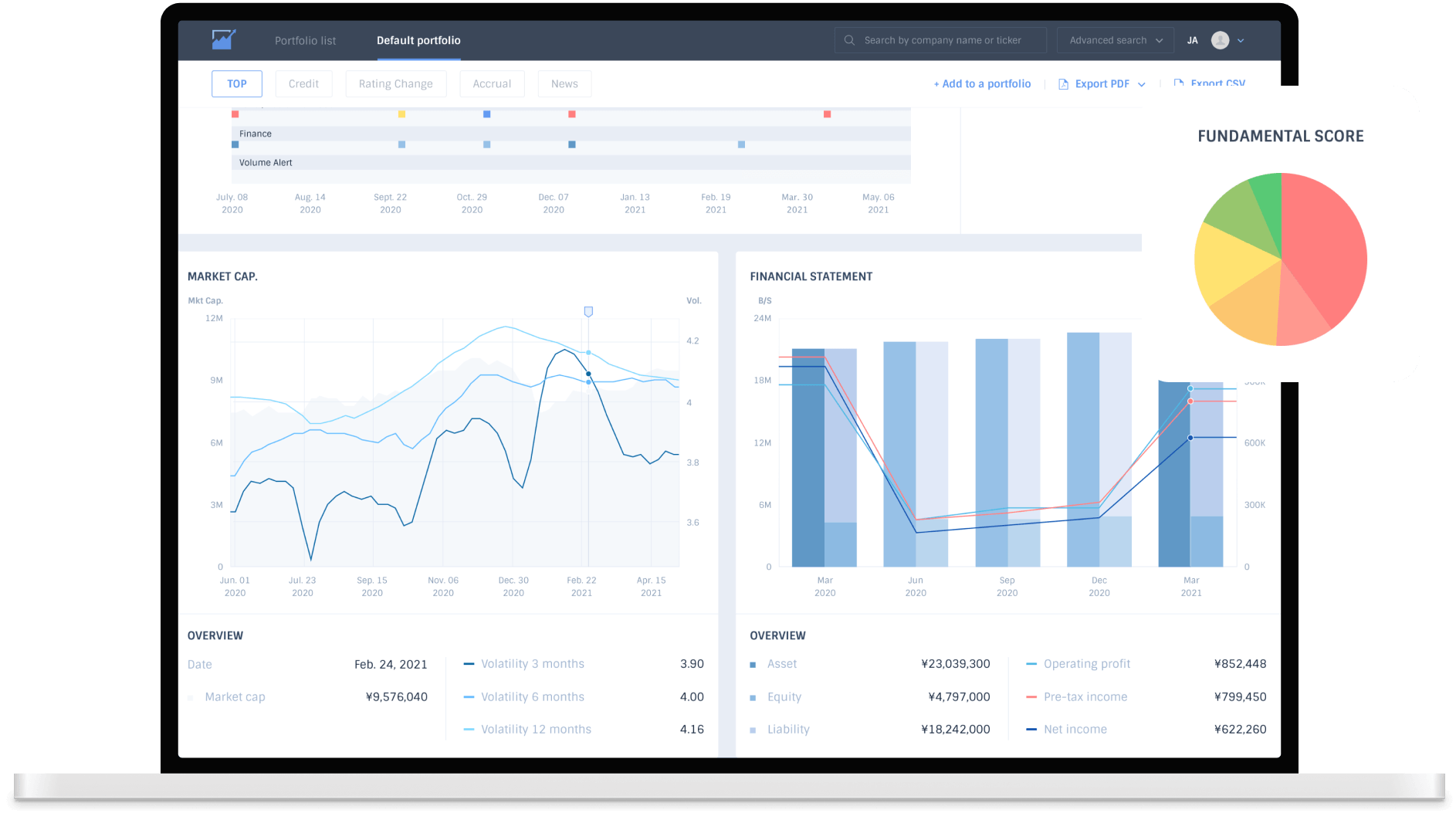

DEFENSE

オプション価格決定理論に基づいた 信用リスク評価により、 上場企業のモニタリング業務を支援します。

View detail

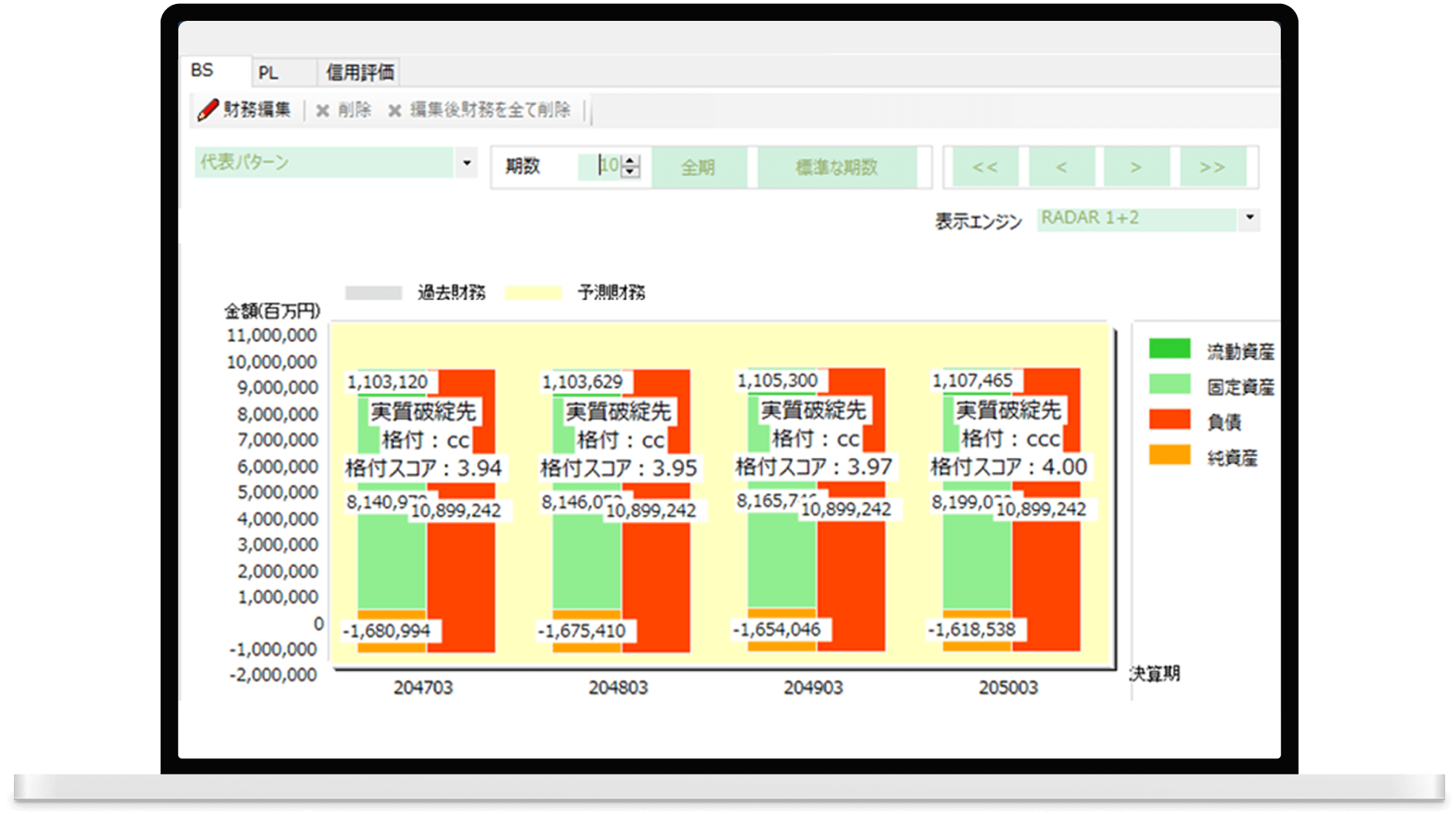

RADAR

統計モデルにより、 財務情報を用いて国内外企業の信用格付を 推計・分析するプロダクトです。

View detail

AERIS

将来財務予測モデルを用いたストレステストにより、フォワード・ルッキングで 高度なリスク管理を支援します。

View detail

CRIS

日本初の気候変動シナリオ分析ツールです。移行リスク・物理的リスク別に 財務諸表や信用コストを予測します。

View detail

MODEL CHECKER EX

スコアリングモデルをはじめとする 格付体系の精度検証、分析業務を サポートします。

View detail

Portfolio EX

モンテカルロ・シミュレーションを 用いたポートフォリオの信用リスク 量計測プロダクトです。

View detail

企業リスク情報

日経テレコンにて、全国約125万社の 評価レポートをご提供します。 (金融工学研究所企業リスク情報)

View detail

会計レントゲン

不正会計リスクに関する包括的なサービスを ご提供します。

View detail

お客様

90+

お客様の数

250+

導入商品数

JS Price 2025年12月末時点

| データ分類 | 銘柄数 | ページ数 |

|---|---|---|

| 国債 | 815 | 13 |

| 公募地方債 (都道府県) | 2621 | 41 |

| 政府保証債 | 591 | 10 |

| 事業債 (電力債を除く) | 3513 | 55 |

| 電力債・放送債・交通債・その他特殊形態社債 | 893 | 14 |

| 計 | 8433 | 133 |

| すべて見る | ||

最新破綻企業評価

| 倒産日 | 企業名 | 証券コード |

|---|---|---|

| 2025/07/30 | 株式会社オルツ | 260A |

| 2024/11/27 | 日本電解株式会社 | 5759 |

| 2023/12/05 | 株式会社プロルート丸光 | 8256 |

| すべて見る | ||

Videos